Although the aerospace industry is leading the effort to combat counterfeiting through methods like serialization tracing and supply chain control, the use and sale of counterfeit parts is still an issue in manufacturing. Counterfeiters are changing with the times too, applying more sophisticated approaches and techniques to skirt testing, laws, and standards. Blanks, clones, and undisclosed remanufacturing are just some of the growing trends infiltrating the world of counterfeit.

Investing in the right prevention procedures, purchasing processes, and product quality controls might seem daunting, but the value of the price of protection far outweighs the cost you might pay for buying, selling, or using counterfeit parts. Here are some steps you can take to mitigate the risk of falling victim to counterfeit.

Know who you’re buying from

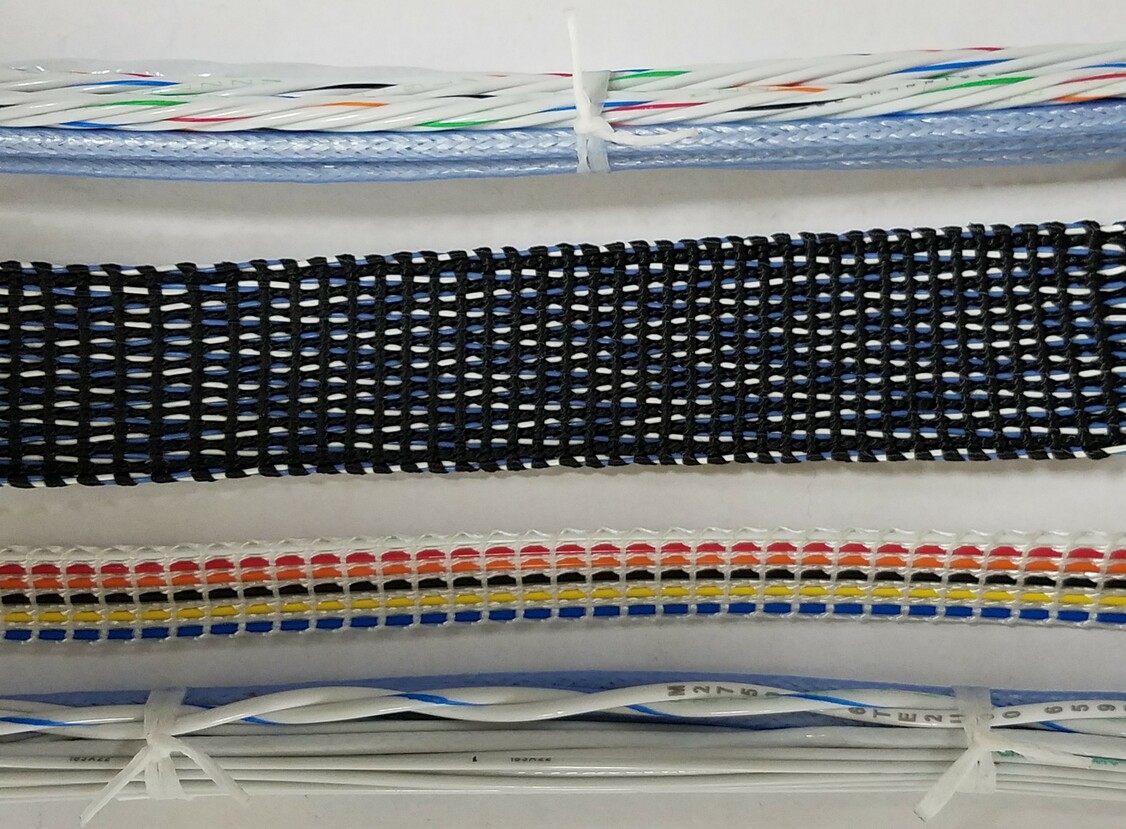

In July of this year, a major US connector manufacturer agreed to pay the United States $11 million to settle a False Claims Act lawsuit that accused the manufacturer of supplying the military with electrical connectors without the proper testing. The allegations spanned nine years of work performed for six models of electrical connectors that were not routinely tested per government requirements. Proper testing and quality control performed on parts such as electrical connectors is imperative to protect and prevent the dangerous purchase and use of counterfeit parts.

Procurement professionals can be enticed by lower costs and lead times for expensive and elusive parts needed for a project, but don’t let that small sticker price seduce you. More often than not, deep discounts and quick turnarounds are too good to be true. Doing the research and meeting all of the requirements for authenticating partners can be daunting, but a reliable contract manufacturer (CM) can alleviate most of this process for OEMs.

Leave the legwork to partners and suppliers

Vetting suppliers can be challenging, and when you purchase parts from multiple different sources, you have to repeat the process all over again. Establishing standards and selecting qualified suppliers during the initial bidding and quoting phase can cement a trustworthy partnership with a supplier from the beginning. When possible, using a single-source supplier can prevent having to hit that reset button continuously.

A trusted CM has purchase quality requirements (PQRs) already in place and has a process for providing documentation for proving parts are not counterfeit. Contract manufacturers can also do the legwork of researching and verifying all of the parts needed when they are provided a Bill of Material or are involved in the early stages of design and can collaborate on the creation of the list of parts needed.

Use reliable resources

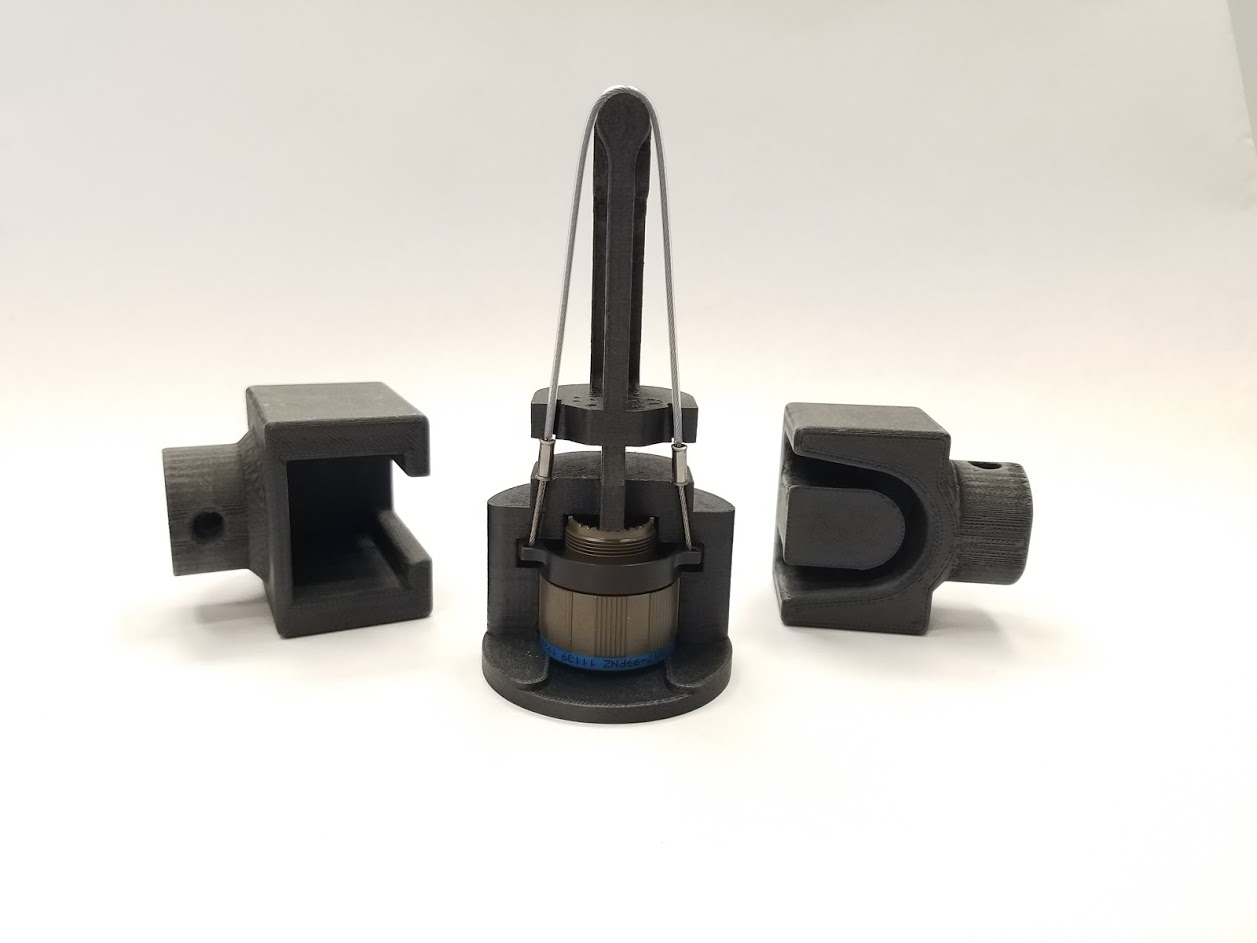

Counterfeiting might be a war that’s constantly waged, but the industry is also always working to sharpen the weapons it can wield in the fight against counterfeit parts. Associations and resources such as the Counterfeit Avoidance Accreditation Program (CAAP), Electronic Components Industry Association (ECIA), and Oxebridge Quality Resources offer trainings, certifications, and strategies for ensuring you only work with authentic parts.

Trustworthy CMs like Liberty Electronics cement themselves as quality partners in manufacturing by becoming certified to ISO 9001 or the aerospace-specific AS9100 standard. Counterfeiters are motivated, but we are more determined than ever to protect the integrity and safety of the industry from the cost and dangers of unauthorized sellers and counterfeit products.

For more information on combating counterfeit materials or to speak with an expert, contact Liberty Electronics today.

![Liberty Electronics® Right Cable Harness Thumbnail Liberty | How the Right Contract Manufacturer Benefits OEMs [Video], Liberty Electronics®](https://blog.libertyelectronics.com/wp-content/uploads/2022/05/Right-Cable-Harness-Thumbnail-Liberty.jpg)

![Liberty Electronics® Quarterly Newsletter Signup CTA | How the Right Contract Manufacturer Benefits OEMs [Video], Liberty Electronics®](https://blog.libertyelectronics.com/wp-content/uploads/2022/04/Quarterly-Newsletter-Signup-CTA.jpg)

![Liberty Electronics® made in usa flag for parade SLKDMXF | Can the U.S. Become its Own Manufacturing Island? [Video], Liberty Electronics®](https://blog.libertyelectronics.com/wp-content/uploads/2022/05/made-in-usa-flag-for-parade-SLKDMXF.jpg)

![Liberty Electronics® 4605c8e5 75f5 44d2 a5e0 5c8cbdf7a85a | Can the U.S. Become its Own Manufacturing Island? [Video], Liberty Electronics®](https://blog.libertyelectronics.com/wp-content/uploads/2023/04/4605c8e5-75f5-44d2-a5e0-5c8cbdf7a85a.png)

![Liberty Electronics® liberty case study page | How to Successfully Switch Suppliers [Video], Liberty Electronics®](https://blog.libertyelectronics.com/wp-content/uploads/2022/04/liberty-case-study-page.jpg)

![Liberty Electronics® supply chain | How to Successfully Switch Suppliers [Video], Liberty Electronics®](https://blog.libertyelectronics.com/wp-content/uploads/2022/05/supply-chain.png)

![Liberty Electronics® Moving up The Bill of Sale Thumbnail Liberty | Advantages of Moving Up the Bill of Materials [Video], Liberty Electronics®](https://blog.libertyelectronics.com/wp-content/uploads/2022/05/Moving-up-The-Bill-of-Sale-Thumbnail-Liberty.jpg)